| Angelina Ritacco —

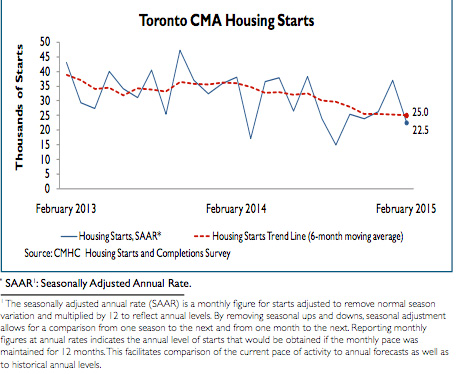

Housing starts in the Toronto Census Metropolitan Area (CMA) trended at 30,194 units in March compared to 25,041 in February according to Canada Mortgage and Housing Corporation (CMHC). The trend is a six month moving average of the monthly seasonally adjusted annual rates (SAAR)(1) of housing starts.

“Housing starts rebounded to an eight-month high in March due to developers starting new high-rise projects, which are part of an increase in pre-construction condominium apartment sales since mid-2013,” said Dana Senagama, CMHC’s Principal of Market Analysis for the GTA. “Strong high rise completions so far this year have also enabled builders to channel more resources to new projects.” “Housing starts rebounded to an eight-month high in March due to developers starting new high-rise projects, which are part of an increase in pre-construction condominium apartment sales since mid-2013,” said Dana Senagama, CMHC’s Principal of Market Analysis for the GTA. “Strong high rise completions so far this year have also enabled builders to channel more resources to new projects.”

CMHC uses the trend measure as a complement to the monthly SAAR of housing starts to account for considerable swings in monthly estimates and obtain a more complete picture of the state of the housing market. In some situations, analysing only SAAR data can be misleading in some markets, as they are largely driven by the multiples segment of the markets which can be quite variable from one month to the next.

The stand alone monthly SAAR was 45,955 units in March, up from 22,551 units in February. This was the result of a significant increase in apartment starts this month.

Total housing completions in the Toronto CMA reached 21,720 units in the first quarter of 2015, while completions of condominium apartments reached a record 17,166 units – already surpassing the annual totals recorded in the past three years. This increase is due to an elevated number of high rise units that have been under construction for the past two years owing to record high rise starts in 2012.

With so many high rise units being fully completed, resource constraints (in terms of machinery and labour) that previously acted as impediments for new projects from breaking ground were less so in the past month. While high rise completions have surged, unsold inventory of condominium apartments rose by just 113 units by the end of the first quarter of 2015, an increase that can easily be absorbed by a market the size of Toronto.

The City of Toronto and the City of Vaughan recorded the first and second highest number of starts in March respectively. Both of these municipalities had a significant number of condominium apartment starts. The next highest number was recorded in Brampton, which saw the largest number of low rise units begin construction.

(1) All starts figures in this release, other than actual starts and the trend estimate, are seasonally adjusted annual rates (SAAR) – that is, monthly figures adjusted to remove normal seasonal variation and multiplied by 12 to reflect annual levels. By removing seasonal ups and downs, seasonal adjustment allows for a comparison from one season to the next and from one month to the next. Reporting monthly figures at annual rates indicates the annual level of starts that would be obtained if the monthly pace was maintained for 12 months. This facilitates comparison of the current pace of activity to annual forecasts as well as to historical annual levels.

|

TheBulletin.ca Journal of Downtown Toronto

TheBulletin.ca Journal of Downtown Toronto