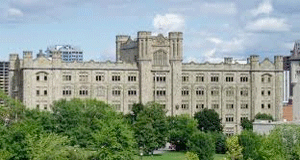

Canada Revenue Agency Headquarters

The Canada Revenue Agency (CRA) announces that Deborah Dieckmann was sentenced to four years in jail and fined $1,285,930 for tax fraud. Her father, George Salmon, was sentenced to two years less-a-day in jail and fined $397,758 for tax fraud. On July 24, 2013 Dieckmann was found guilty, in the Superior court of Justice, of seven counts of fraud over $5,000, while Salmon was found guilty of one count of fraud over $5,000.

They still owe back taxes or it’s back to jail for many, many more years

Dieckmann, upon her release from jail after serving her term, will have one year to pay the fine or she will serve an additional five consecutive years in jail. Salmon was also given one year, upon his release from jail after serving his term, to pay the fine or he will serve an additional three years in jail.

A CRA investigation found that from 2003 to 2006, Dieckmann, through a complicated system of nominee directors, controlled and operated staffing companies that provided temporary workers and payroll services to various clients. Dieckmann failed to remit to the CRA payroll deductions (Canada Pension Plan contributions and Employment Insurance premiums) and income tax deductions collected from clients on behalf of the temporary workers. Dieckmann also failed to remit payroll and income tax deductions on behalf of clients for whom her companies were administering the payroll. During the period in question approximately $5.8 million was not remitted to the CRA. The court found that Dieckmann derived a direct personal benefit from the diverted deductions.

The CRA investigation further revealed that George Salmon, Dieckmann’s father and owner of TPM Machining Group, knowingly used the payroll services of the Dieckmann companies to avoid the remittance of payroll and income tax deductions to the CRA on behalf of his employees.

The preceding information was obtained from the court records.

“The Canada Revenue Agency pursues tax evaders to maintain public confidence in the integrity of the tax system,” said Vince Pranjivan, Deputy Assistant Commissioner of the Ontario Region of the Canada Revenue Agency. “Canadians have to trust that our self-assessment system is working and that it is fair.”

Taxpayers who have not filed returns for previous years, or who have not reported all of their income, can still voluntarily correct their tax affairs. They may not be penalized or prosecuted if they make a valid disclosure before they become aware of any compliance action being initiated by the CRA against them. These taxpayers may only have to pay the taxes owing, plus interest. More information on the Voluntary Disclosures Program (VDP) can be found on the CRA’s Web site at www.cra.gc.ca/voluntarydisclosures.

Further information on convictions can also be found in the Media Room on the CRA website at www.cra.gc.ca/convictions.

TheBulletin.ca Journal of Downtown Toronto

TheBulletin.ca Journal of Downtown Toronto