CommunityAIR says city staff sold out to Port Authority on what city estimated was $50 million of upaid taxes

By Brian Iler –

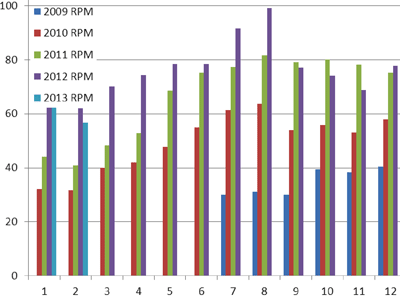

Chart indicates Porter Air’s reported Revenue Passenger Miles (RPM) flown since 2009

We’ve watched the tortured progress of the City’s efforts to force the Toronto Port Authority to pay up its tax arrears, for years now. Now, after successfully intervening in two similar cases in the Supreme Court of Canada, and, based on those wins, winning its own appeal in the Federal Court, The City is ready to cave to the persistent refusal of the TPA to pay its fair share of property taxes.

According to City officials, the amount in issue is well in excess of $50M.

The City has kept the proposed settlement confidential. But TPA Chair Mark McQueen couldn’t restrain himself, revealing in a letter to MP Olivia Chow dated February 28, now posted on the TPA’s website, that the TPA will calculate and pay its taxes on its Island Airport based on a per passenger charge of 80 cents, retroactive, and 94 cents for 2013.

This is a serious defeat. Until recently, passenger volume at the Island Airport was minimal, and, at 80 cents a passenger, City will receive far less than it should have, based on market value assessment.

No other property owner in Toronto is able to pay its taxes based on the amount of business it does on the property. Every other property owner has to pay based upon a fair market valuation of the property.

The City had valued the Island Airport lands for tax purposes at $42,944,060 in 2007. The TPA took the position they had only nominal value.

Airports and municipalities have long sparred over how property taxes are to be collected – several Ontario airports, including Pearson, have succeeded in persuading the province to enact a Regulation under the Assessment Act that permits those airports to pay a per passenger fee.

While the TPA has lobbied the province for similarly treatment, it has not succeeded.

Municipalities object to a per passenger fee, because the amounts can be far less than they would collect based on fair market value – and are variable, depending on how successful the airport is at attracting passengers.

The City of Toronto, in 2006, argued strongly for a market value approach for Pearson:

Prior to 2001, the PILT paid by the GTAA was determined by multiplying the property value by a tax rate. And lastly, the difference in potential PILT revenue that arises from the use of the current method versus a CVA-based method represents a direct revenue shortfall.

Calculating property taxes based on a per passenger charge is, in reality, a municipal subsidy of air travel: airports need huge swaths of land – the Island Airport occupies 215 acres of some of the most valuable land in Toronto – but argue they shouldn’t be forced to pay based on that land value.

Council needs to ask: what would the payments have been if they were calculated on the basis of fair market value, and not passenger traffic? The difference between that amount, and the amount the proposed settlement indicates, is the amount of the subsidy that the City is now contemplating giving to the Island Airport.

That subsidy would become immense if the Island Airport once again reverts to a lightly used general aviation airport, as is quite possible given the shaky fortunes of its primary tenant, Porter.

Why has City staff caved? Three reasons:

• Although federal agencies like the TPA are obliged to make payments in lieu of taxes on the same basis as other taxpayers, constitutional law allows federal agencies to hide behind a fiction that their payments are voluntary. The TPA has grossly abused that fiction, even though the courts have said repeatedly that they must pay like everyone else.

• Fatigue. The City has valiantly fought for payment of a fair amount of taxes for since the TPA was formed in 1999. Although an earlier decision in favour of the TPA was overturned in 2010 by the Federal Court, it did not move promptly to take the matter back to the obscure federal tribunal responsible for deciding this matter. To our knowledge, the tribunal, which heard the matter in January, has not rendered a decision. It is possible that the Tribunal has indicated it would again side with the TPA.

• Politics: The TPA has many friends on City Council – Rob Ford among them.

Iler is chairman of CommunityAIR, a Downtown community group that oversees the Toronto Port Authority and the Island Airport

TheBulletin.ca Journal of Downtown Toronto

TheBulletin.ca Journal of Downtown Toronto